How To Find Noi With Cap Rate

What is Capitalization Rate (Cap Rate)?

Capitalization rate (or Cap Rate for short) is usually used in real estate and refers to the rate of return on a property based on the net operating income (NOI) that the property generates. In other words, capitalization rate is a return metric that is used to determine the potential return on investment or payback of capital.

Larn more in CFI'southward Real Estate Modeling Class.

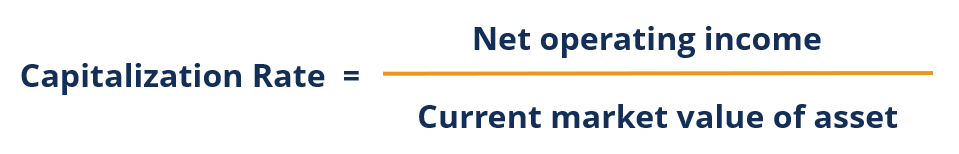

Cap Rate Formula

The formula for Cap Rate is equal to Cyberspace Operating Income (NOI) divided by the electric current market value of the asset.

Where:

- Net operating income is the almanac income generated by the property after deducting all expenses that are incurred from operations including managing the property and paying taxes.

- Current marketplace value of the nugget is the value of an nugget on the marketplace.

Importance of Capitalization Charge per unit

The capitalization rate is used to compare different investment opportunities. For example, if all else equal, a holding with a 10% cap rate versus another holding'due south 3%, an investor is most likely to focus on the property with a ten% cap rate.

The rate also indicates the corporeality of time it takes to recover an investment in a property. For example, if a property comes with a x% cap, it will take x years for the investor to recover his investment (called "fully capitalized").

Although information technology'south an important metric in comparison investment opportunities, investors should never base a purchase on the cap charge per unit of a property alone. Information technology is useful to notation that different cap rates represent dissimilar levels of risk – a depression cap rate implies lower risk while a high cap rate implies higher risk. Therefore, at that place is no "optimal" cap rate – information technology depends on the investor'southward hazard preference.

For example, consider two properties in different geographical locations – one is in a highly coveted suburban region while the other is in a run-down part of the city. The belongings in the highly coveted suburban region would evidence a lower cap through the high market value of the asset. On the contrary, the property located in the run-downwardly part of the city would come with a higher cap, reflected by the lower marketplace value of that asset.

Cap Charge per unit Example

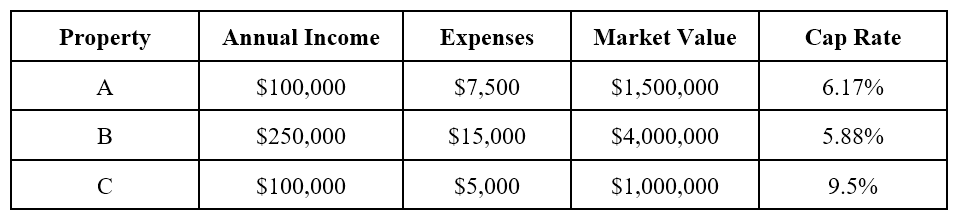

John is an investor looking to buy an investment property. From taking real estate courses, he remembers that the capitalization rate is an constructive metric in evaluating real estate backdrop. John identifies iii backdrop with their respective expenses, annual income, and market values:

After doing the calculations for the properties above, John realizes that Holding C returns the highest cap rate.

In a unproblematic world, John may base of operations his purchase on the rate alone. However, it is only i of many metrics that can be used to assess the return on commercial real manor property. Although cap rate gives a skillful idea of a property's theoretical return on investment, it should be used in conjunction with other metrics such as the gross rent multiplier, among many others. Therefore, other metrics should be used in conjunction with the capitalization rate to approximate the attractiveness of a real estate opportunity.

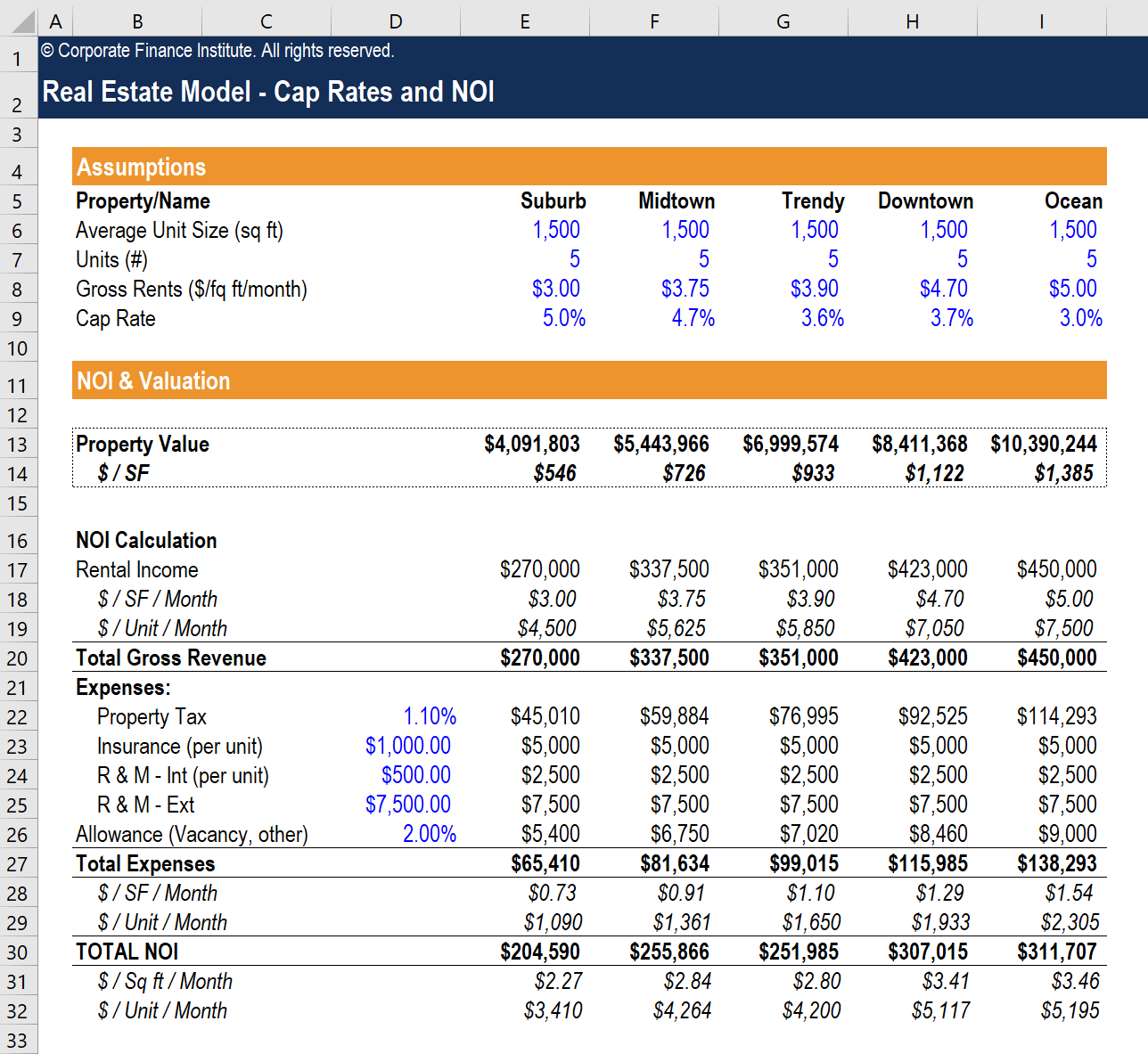

Real Estate Modeling Course

If you want to larn all about how to calculate internet operating income, capitalization rates, and even how to build a financial model for a evolution project, check out CFI's Real Estate Financial Modeling Course. The programme will teach you how to build a model in Excel from scratch.

Cap Rate Summary

- The capitalization rate is a profitability metric used to determine the return on investment of a real estate property.

- The formula for the capitalization charge per unit is calculated as net operating income divided past the current market value of the asset.

- The capitalization rate tin be used to decide the riskiness of an investment opportunity – a loftier capitalization rate implies higher risk while a depression capitalization rate implies lower risk.

- The capitalization rate should exist used in conjunction with other metrics and investors should never base of operations a purchase on the capitalization rate of a holding alone.

Related Readings

Thank you for reading CFI'southward guide to Capitalization Charge per unit. To keep advancing your career, the additional resources below will be useful:

- Foundations of Real Manor Financial Modeling

- Investing: A Beginner's Guide

- Charge per unit of Return

- Revenue Run Rate

How To Find Noi With Cap Rate,

Source: https://corporatefinanceinstitute.com/resources/knowledge/valuation/capitalization-cap-rate/

Posted by: hendrixdesten.blogspot.com

0 Response to "How To Find Noi With Cap Rate"

Post a Comment